child tax credit for december 2021 amount

As part of the 19 trillion American Rescue Plan Act that passed in March 2021 Congress enhanced the child tax credit for one year beefing up payments to 3600 for each child up to age 6 and. Who is Eligible.

Child Tax Credit Could Spur 1 5 Million Parents To Leave The Workforce Study Says Cbs News

Enter Payment Info Here tool or.

. 2018 Earned Income Tax Credit Tool. 2015 EITC or Earned Income Tax Credit. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17.

You andor your child must pass all seven to claim this tax credit. Learn more about the Advance Child Tax Credit. Millions of families received up to 300 per child in monthly payments from July to December 2021 if they were eligible.

Any amount of monthly Child Tax Credit payments received last year will reduce the amount of remaining Child Tax Credit you are eligible for when filing your tax return this year. 2020 Earned Income Tax Credit Calculator. Full 2021 tax credit.

2017 EIC Calculator for the Earned Income Tax Credit. Length of residency and 7. How big will your child tax credit be on your 2021 tax return.

Advanced Payments of the Child Tax Credit 2021 CTC paid made monthly from July-December to eligible taxpayers starting 0715. Eligible families from July to December 2021. Use our child tax credit calculator to determine your eligibility for tax year 2020 or tax year 2021.

When you file your 2021 tax return you can claim the other half of the total CTC. In 2021 a full 3600 child tax credit was available to couples making less than 15000 or 75000 for singles. Find COVID-19 Vaccine.

Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return or. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. To get money to families sooner the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the ages of 6 and 17.

For the 2021 taxable year only in the case of the credit for a. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. The letter says 2021 Total Advance Child Tax.

The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements. In December 2021 the IRS started sending letters to families who received advance Child Tax Credit payments. Even if you had 0 in income you could have received advance Child Tax Credit payments if you were eligible.

Entered your information in 2020 to get stimulus Economic Impact payments with the Non-Filers. Section 9621 of the ARPA temporarily expands EITC eligibility and increases the amount of the credit for taxpayers with no qualifying children. The first one applies to the extra credit amount added to the 2021 credit ie the additional 1000 or 1600 for each child over the 2000 amount allowed in 2020.

To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have. 2016 EITC Estimator Tool. The IRS pre-paid half the total credit amount in monthly payments from July to December 2021.

Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021 generally based on the information contained in your 2019 or 2020 federal income tax return. Parents income matters too. A childs age determines the amount.

Half the total credit amount was paid in advance with the monthly payments last. See how to claim the Earned Income Tax Credit for back taxes or previous tax years. 2019 EITC Estimator for the Earned Income Credit.

Always Keep Employee Td1 S Up To Date Tax Credits Hiring Employees New Bus

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

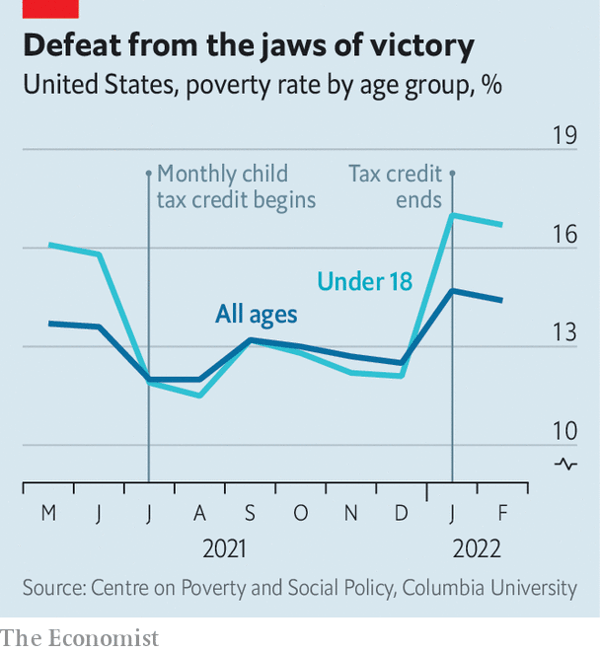

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

2021 Child Tax Credit Advanced Payment Option Tas

/cdn.vox-cdn.com/uploads/chorus_image/image/71300653/bigbill.0.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Voters Are Divided Over One Year Extension Of Expanded Child Tax Credit

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Child Tax Credit Will There Be Another Check In April 2022 Marca

The Child Tax Credit Toolkit The White House

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

What You Need To Know About The 2021 Child Tax Credit Changes America Saves

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities